are campaign contributions tax deductible in 2019

While you cant write off campaign contributions you can set aside 3 of your taxes to go to the Presidential Election Campaign Fund on your 1040 federal income tax return. Special 300 Tax Deduction The Internal Revenue Service has a special new provision that will allow more people to easily deduct up to 300 in donations to qualifying charities this year even if they dont itemize.

Are Contributions To Nonprofit Schools Tax Deductible Turbotax Tax Tips Videos

The 2019-2020 contribution limit was capped at 2800.

. It doesnt matter if it is an individual business or other organization making the donation the campaign contribution is not deductible. This includes Political Action Committees PACs as well. Advertisements in convention bulletins and admissions to dinners or programs that benefit a political party or political candidate are not deductible it says in IRS Publication 529.

For many people the tax break from Uncle Sam is almost as big a motivating factor as altruism. We all know that donations to charity are tax deductible. Political action committees and individual candidates in local state and federal elections are all fair game as long as theyre on a ballot in the state during.

How to get to the area to enter your donations. 50 limit on anonymous contributions. Individuals can donate up to 2900 to a candidate committee per election up to 5000 per year to a PAC and up to 10000 per year to a local or district party committee.

Qualified contributions are not subject to this limitation. Between his campaign and joint fundraising committees Trump raked in nearly 64 million from small-dollar donors during the first six months of 2019 an average of 350000 per day. If you make less than 200000 jointly or 100000 individually you can claim a tax credit of 100 and 50 respectively.

With the 2020 elections behind us and tax-filing season now here you might be wondering whether or not you can deduct political contributions you made last year. An anonymous contribution of cash is limited to 50. While inside the software and working on your return type charitable donation in the Search at the top of the screen you may see a magnifying glass there.

A corporation may deduct qualified contributions of up to 25 percent of its taxable income. Can I deduct my contributions to the Combined Federal Campaign CFC. Taxability of election contribution.

The May 2019 elections are fast approaching. Learn how campaign contributions can be used when an election is over. People everywhere from radio blurbs to posts on social media are.

Political donations are not tax deductible on federal returns. Even though political contributions are not tax-deductible there are still restrictions on how much individuals can donate to political campaigns. 100 limit on cash contributions A campaign may not accept more than 100 in cash from a particular source with respect to any campaign for nomination for election or election to federal office.

Individuals may deduct qualified contributions of up to 100 percent of their adjusted gross income. No donations to political parties are not tax deductible. You cannot deduct contributions made to a political candidate a campaign committee or a newsletter fund.

The state is very open about where you can donate. As circularized in Revenue Memorandum Circular RMC 38-2018 and as reiterated in RMC 31-2019 campaign contributions are not included in the taxable income of the candidate to whom they were given the reason being that such contributions were given not for the personal expenditure or enrichment of the concerned candidate but for the purpose of utilizing. When people do give most political donations are large given by a few relatively wealthy people.

While there is no tax. Are Political Contributions Tax. Generally only a small minority of total contributions come from those who give 200 or less.

According to the IRS the answer is a very clear NO. View solution in original post. No political contributions are not tax-deductible.

Alternatively candidates could legally match donors political contributions using personal funds. You cannot deduct expenses in support of any candidate. The answer is no political contributions are not tax deductible.

Count me among those smaller donors who has given a bit here and there to campaigns. Unutilizedexcess campaign funds that is campaign contributions net of the candidates campaign expenditures will be considered subject to income tax and as such must be included in the candidates taxable income as stated in his or her income tax return filed for the subject taxable year. Its only natural to wonder if donations to a political campaign are tax deductible too.

Wrongfully claiming political contributions can and will attract the attention of the Internal Revenue Service and can lead to an assessment of additional taxes due penalties and interest. Any amount in excess of 50 must be promptly disposed of and may be used for any. 6 hours agoIn the hours after at least 19 children and two teachers were killed at an elementary school in Uvalde Tex in the deadliest mass shooting at an American school in.

Yes you can deduct them as a Charitable Donation if you file Schedule A.

Image Result For Pledge Cards For Fundraising Card Templates Free Card Template Card Templates Printable

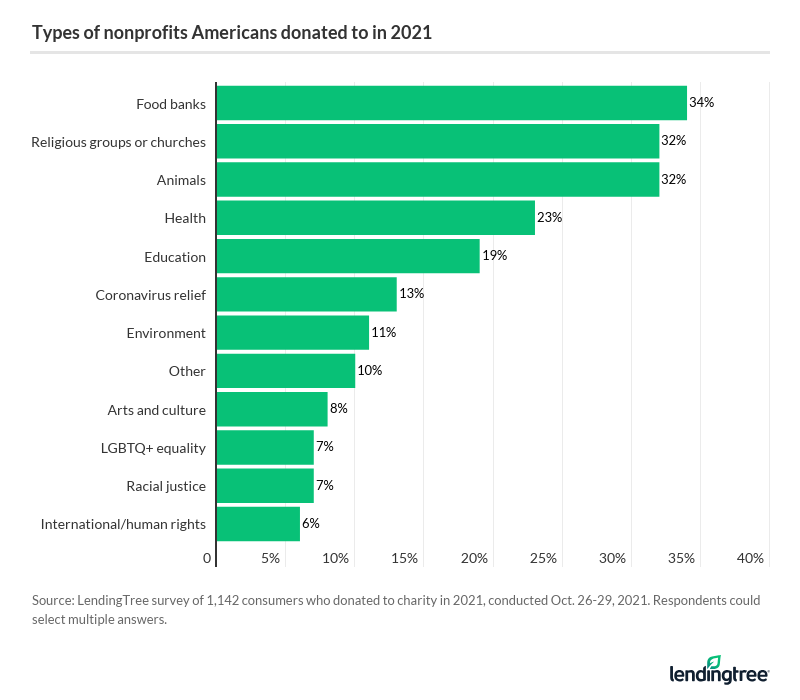

56 Of Americans Donated To Charity In 2021 Lendingtree

Are Political Contributions Tax Deductible H R Block

Are Political Donations Tax Deductible Credit Karma Tax

How To Deduct Appreciated Stock Donations From Your Taxes Cocatalyst

How Much Should You Donate To Charity District Capital

Campaign Finance Info Pittsburghpa Gov

Super Bowl 2019 Michael Vick Super Bowl Championship Game

A New Report From The Nonprofit Nonpartisan Tax Foundation Indicates Only France S 36 Percent Corporate Tax Rate Is Hig Tax Deductions Income Tax Filing Taxes

How To Deduct Appreciated Stock Donations From Your Taxes Cocatalyst

Fundraising Planning Guide Calendar Worksheet Template Marketing Plan Template Fundraising Marketing Nonprofit Fundraising

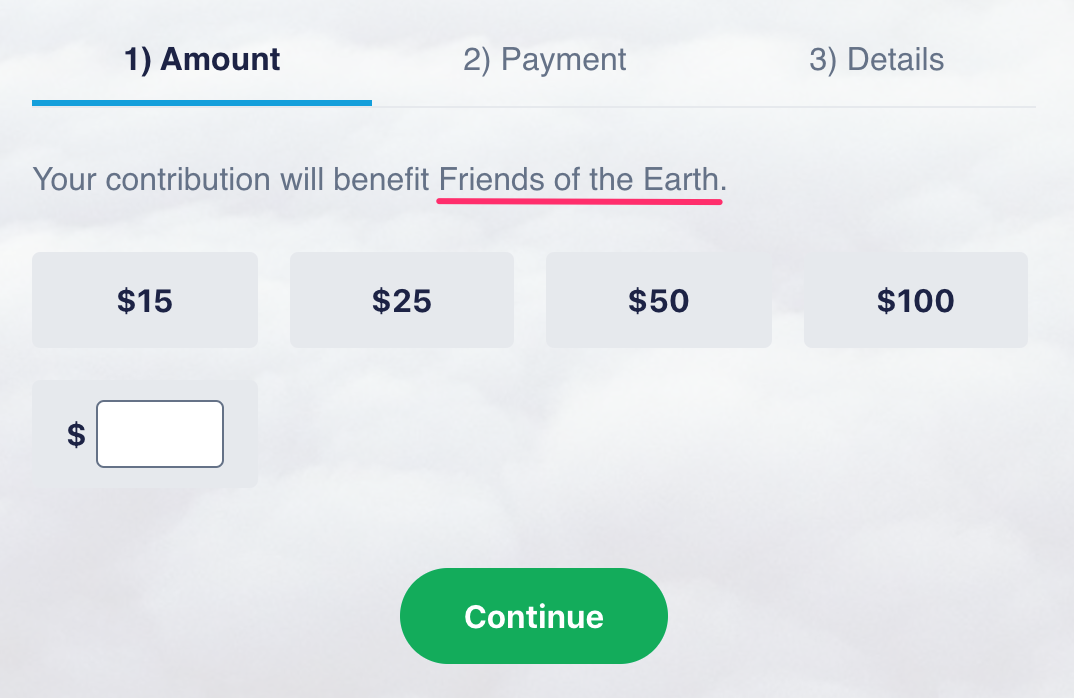

What Happens To My Money When I Donate Actblue Support

Are Political Contributions Tax Deductible Turbotax Tax Tips Videos

Donation Pledge Card Template 8 Sample Pledge Forms Pdf Word Pledge Lesson Plan Template Free Card Template

Are Political Contributions Tax Deductible H R Block

Charitable Deductions On Your Tax Return Cash And Gifts

How To Maximize Your Tax Deductible Donations Forbes Advisor

We Thank Each And Every One Of You Who Have Been A Part Of Our Contribution And Has Helped Make This Campaign A Success T You Better Work No Response Thankful